To understand the impact of Trump's tariff war, watch the bond market and the Fed--not just the stock market

https://www.atlanticcouncil.org/blogs/new-atlanticist/to-understand-the-impact-of-trumps-tariff-war-watch-the-bond-market-and-the-fed-not-just-the-stock-market/

https://www.atlanticcouncil.org/blogs/new-atlanticist/to-understand-the-impact-of-trumps-tariff-war-watch-the-bond-market-and-the-fed-not-just-the-stock-market/

The imposition of US tariffs and retaliatory tariffs by some trading partners, combined with a ninety-day pause of most “reciprocal” tariffs by US President Donald Trump, have led to extreme

financial market volatility in recent days. While the equity market gyrations have occurred in

relatively orderly market conditions so far, some recent developments have signaled that selling pressure may have spread to other markets—particularly US Treasury securities and short-term US dollar funding.

To understand the financial stability impacts of the current market turmoil, it is important to monitor the pressure on these markets, which are crucial for the smooth functioning of the global financial system. Left unaddressed, these strains could trigger a freezing up of financial markets, raising the risk of a serious financial crisis.

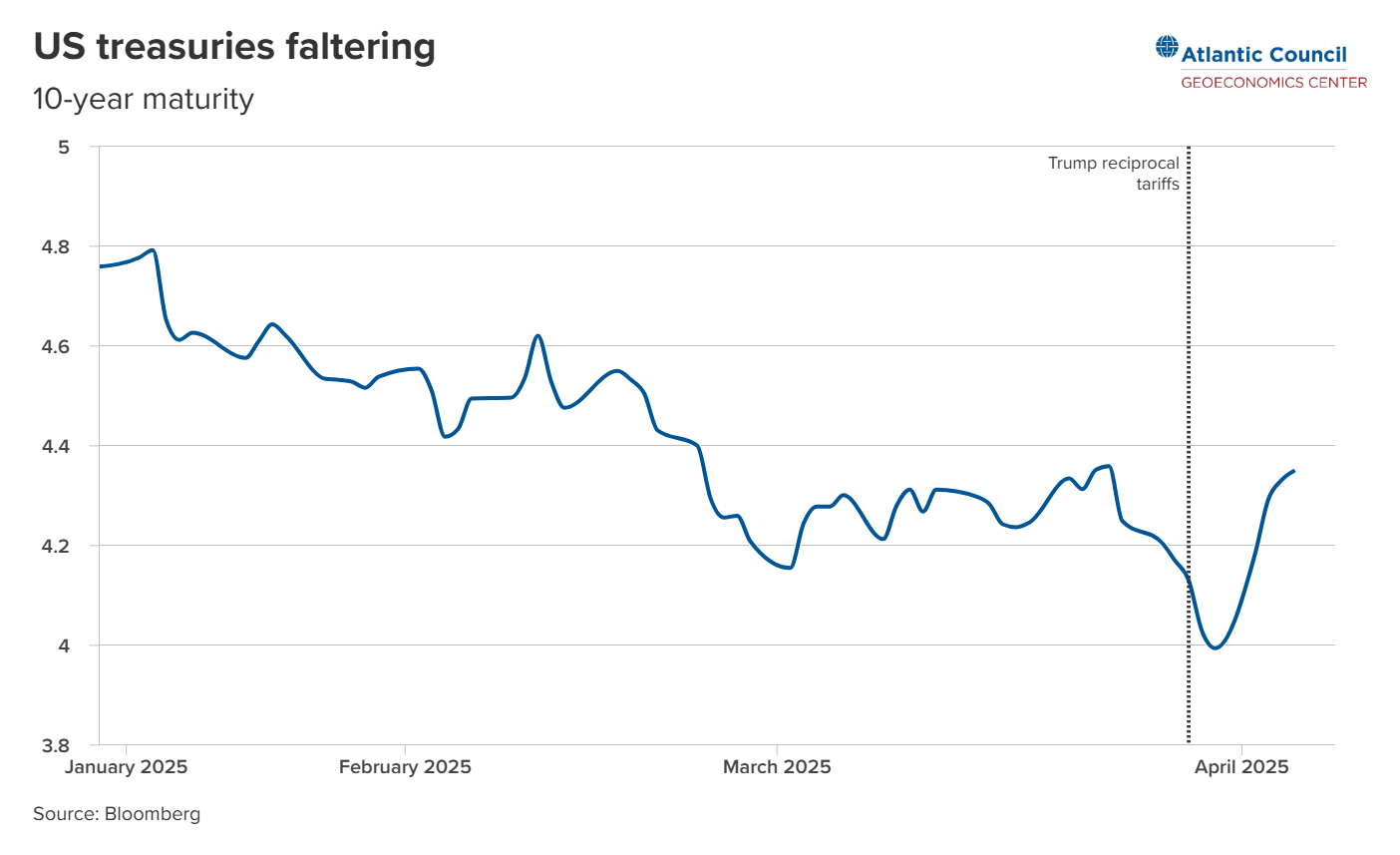

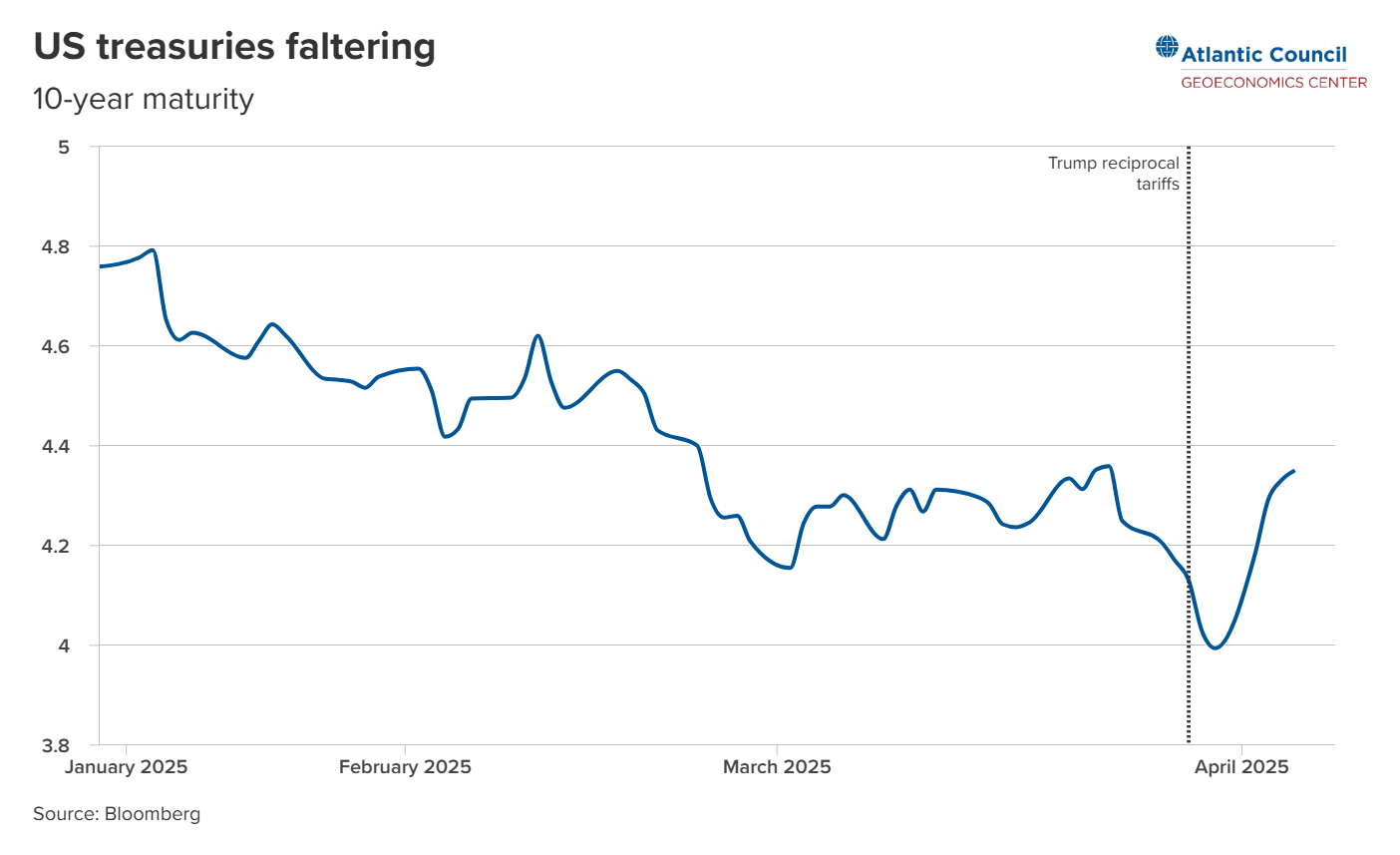

Safe haven asset status of US Treasuries in doubt

When financial markets come under stress, investors usually shift money into safe haven assets—which until now have been the US dollar and US Treasury securities. This time around, these markets have behaved differently from expectations. On April 2, when Trump announced higher than expected “reciprocal” tariffs, triggering sharp stock market selloffs, the

ten-year US Treasury yield stood at 4.17 percent. Yields indeed fell (which means bond prices increased) in the next few days to reach 3.96 percent on April 4. But then yields rose in the following week to hit 4.34 percent (seventeen basis points higher than on April 2) at the end of April 9 when the stock market rallied after Trump announced the ninety-day reprieve. This is contrary to expectations. Usually, US Treasury yields decline during market turmoil as investors move to US Treasury securities as safe haven assets.

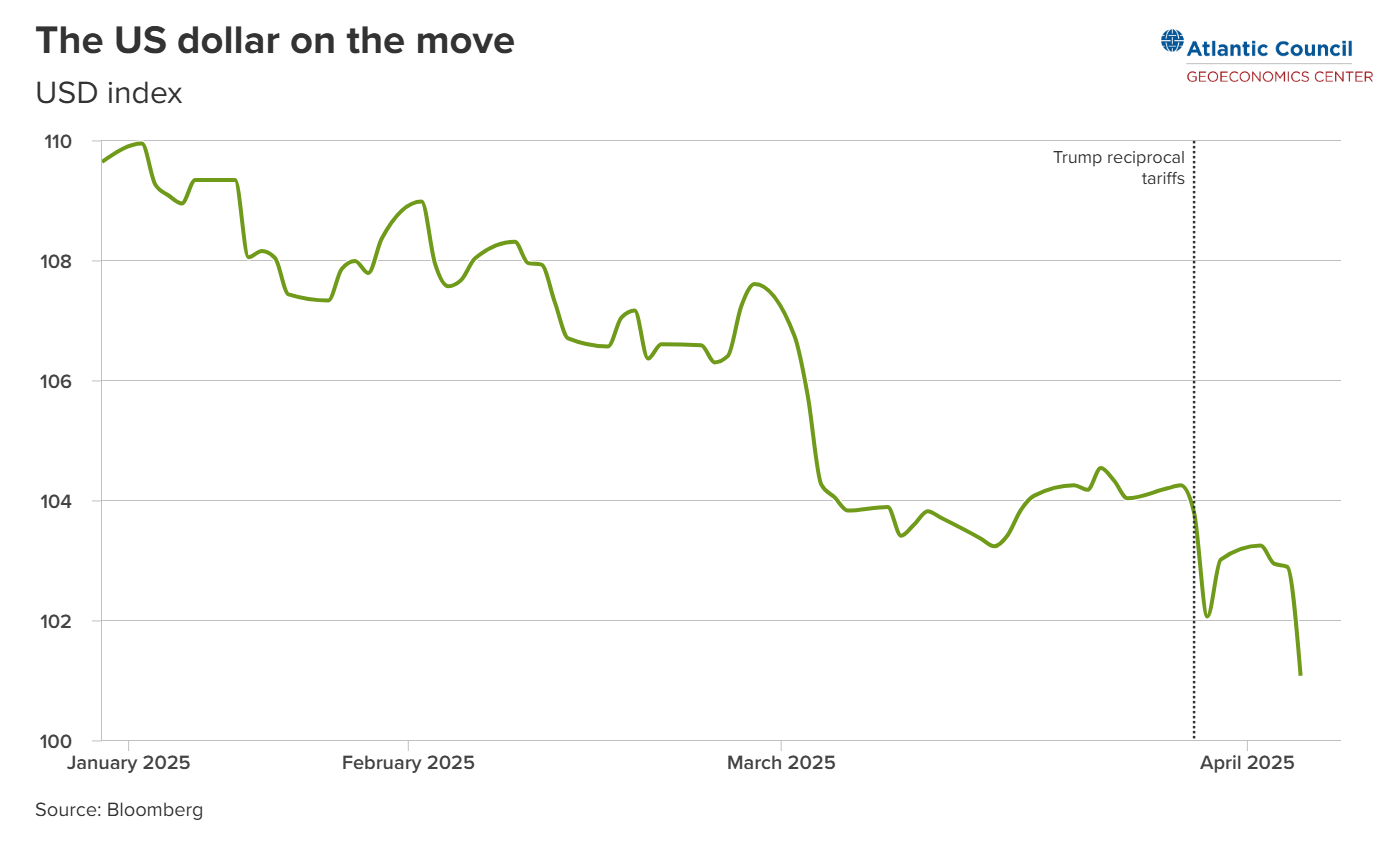

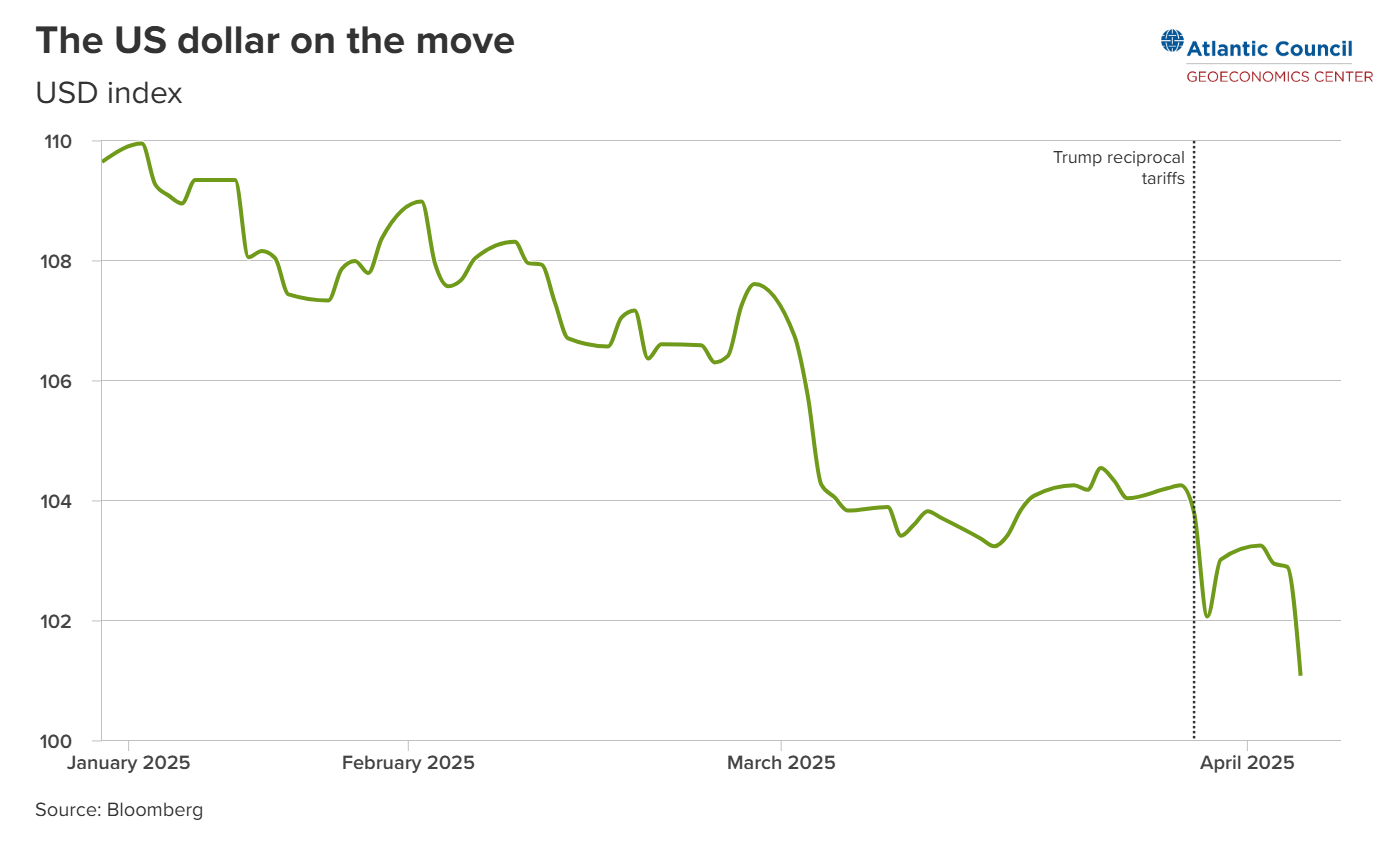

Similarly, the

US dollar index (representing its value against the Group of Ten major trading partners) weakened from 104.2 on April 2 to 103.2 on April 9, instead of strengthening, as usually happens during market routs when international investors tend to flock to the US dollar for safety.

snip