Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

Editorials & Other Articles

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

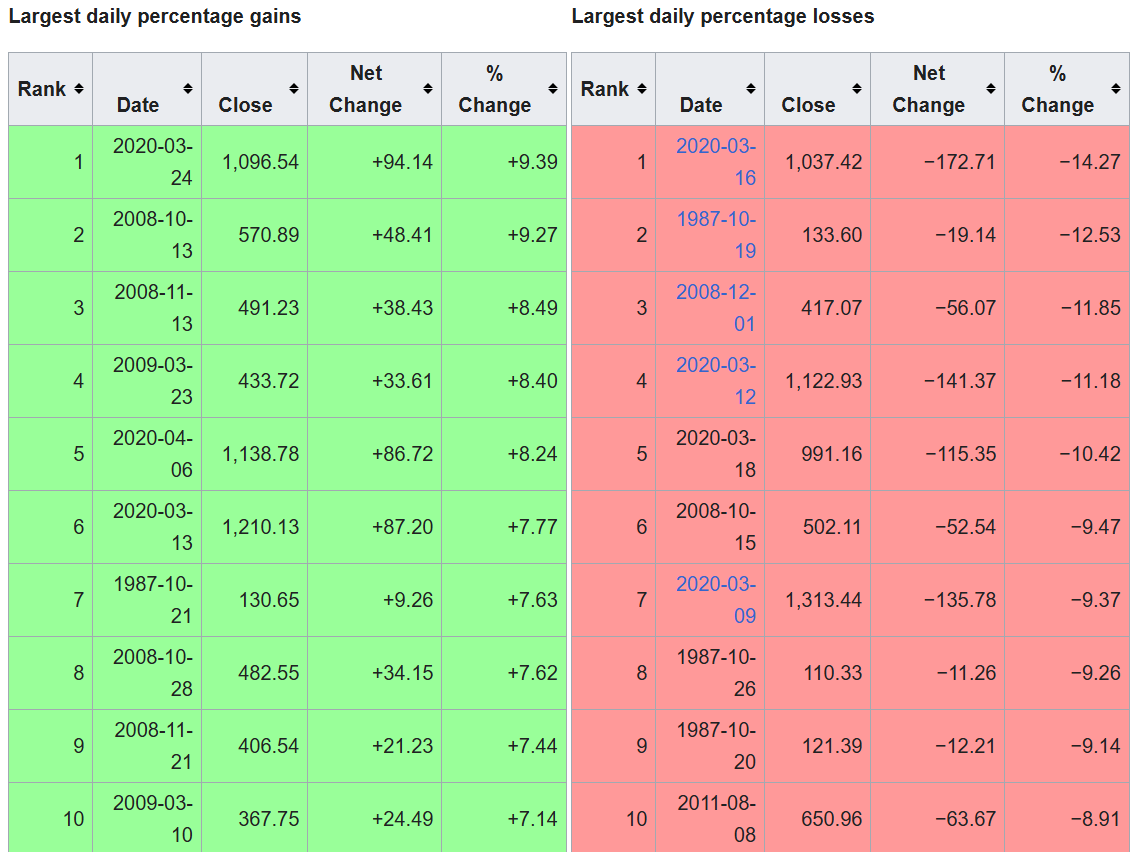

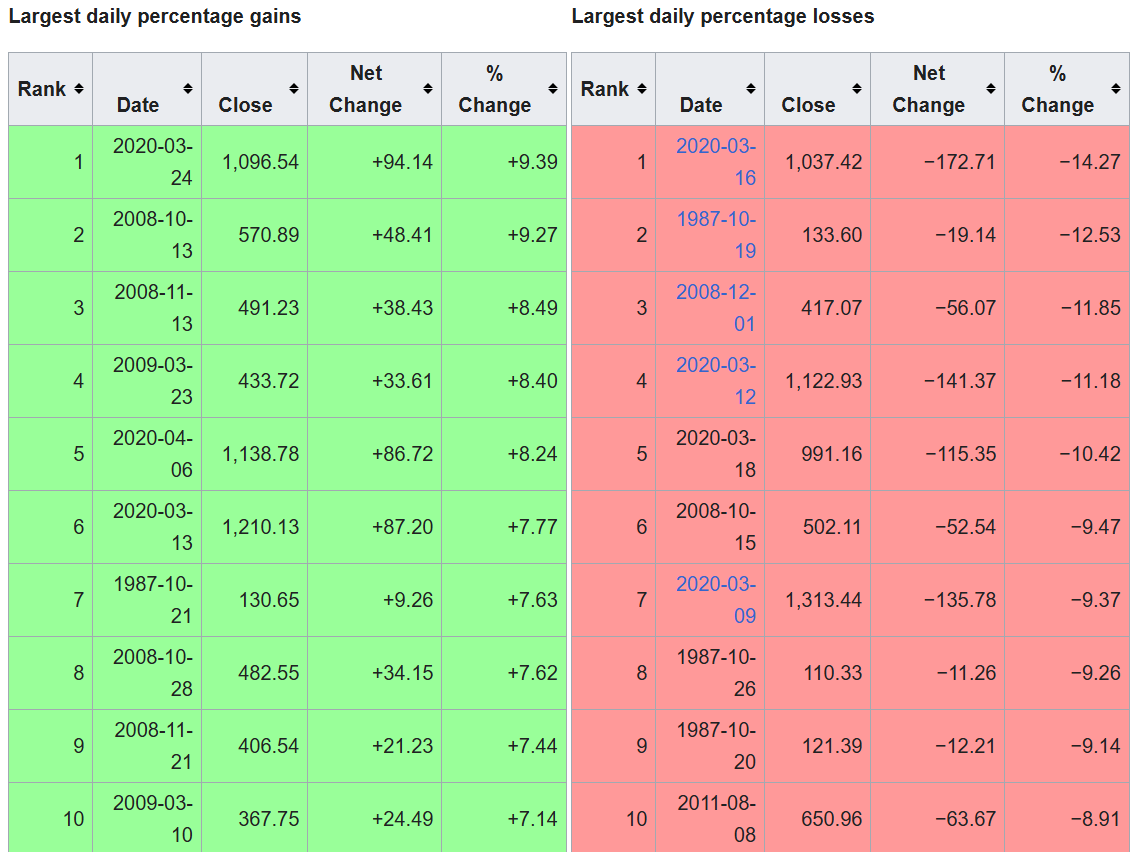

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsList of largest daily changes in the Dow Jones Industrial Average

https://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

9 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

List of largest daily changes in the Dow Jones Industrial Average (Original Post)

Celerity

Apr 5

OP

Thx, it is percentages at least, but bear in mind the Dow is an 1896 adding machine price-weighted 30 stock index

Bernardo de La Paz

Apr 5

#2

List of largest daily changes in the S&P 500 Index, Nasdaq Composite, and the Russell 2000 Index

Celerity

Apr 5

#5

malaise

(283,029 posts)1. K & R for visibility

Important

Bernardo de La Paz

(54,726 posts)2. Thx, it is percentages at least, but bear in mind the Dow is an 1896 adding machine price-weighted 30 stock index

The S&P 500, Nasdaq Composite and Russel 2000 indices are much more useful. The first two are capitalization weighted and the latter is a combination of capitalization weighting and possibly some jiggering about being on other indices that I haven't found clarity on.

To understand how weighting works, consider the Dow Jones Industrial Average®, which uses a very simple weighting method: price weighting. If Merck, a constituent of The Dow®, had a share price of USD 90, and the sum of the share prices of all DJIA component stocks was USD 4,300, then the weight of Merck in The Dow would be USD 90/USD 4,300 = 2.1%. If Visa, another DJIA component, had a share price of USD 180, it would have a weight of USD 180/USD 4,300 = 4.2%. Because the weight of Visa is twice that of Merck, a 10% change in the share price of Visa would have twice the impact on the performance of The Dow that a 10% change in the share price of Merck would.

Celerity

(49,327 posts)5. List of largest daily changes in the S&P 500 Index, Nasdaq Composite, and the Russell 2000 Index

S&P 500 Index

Nasdaq Composite

Russell 2000 Index

Nasdaq Composite

Russell 2000 Index

Bernardo de La Paz

(54,726 posts)8. Great. Provides good perspective. Thurs not on any 20 list, Friday on one only. We'll see about Monday. Thanks. nt

Response to Celerity (Original post)

MichMan This message was self-deleted by its author.

Stallion

(6,632 posts)4. Shocking that Almost all the Major Declines Came Under Republican Administrations

how do they get away with the Party of Bosiness nonsense

WarGamer

(16,928 posts)6. Trump equals volatility

He owns most of the largest NET market days LOSING and owns most of the largest NET WINNING days on the markets.

I'd prefer stability.

Xavier Breath

(5,507 posts)7. Guessing that 1899-12-18 was the day the actual bull died.

Celerity

(49,327 posts)9. December 18, 1899: Dow Drops Amidst Panic Over Liquidity Crunch (-8.7%)

https://www.dividend.com/dividend-education/inside-the-10-worst-days-of-dow/

By December 1899, the U.S. had suffered a series of investors’ panic that saw the failure of companies like John P. Squire & Co, a Boston-based pork packager, and banks like Broadway National Bank. The economic scenario was not helping either, with deflationary pressure, dropping silver reserves and declining copper stocks.

As a result, trading of several firms was suspended on the stock exchange and the banking system, led by the likes of J.P. Morgan & Co., had to come to the rescue. Panic took over investors’ minds, leading to an 8.7% dip in the Dow.

By December 1899, the U.S. had suffered a series of investors’ panic that saw the failure of companies like John P. Squire & Co, a Boston-based pork packager, and banks like Broadway National Bank. The economic scenario was not helping either, with deflationary pressure, dropping silver reserves and declining copper stocks.

As a result, trading of several firms was suspended on the stock exchange and the banking system, led by the likes of J.P. Morgan & Co., had to come to the rescue. Panic took over investors’ minds, leading to an 8.7% dip in the Dow.

The Panic Of '99 - 1899, That Is; Giddy Speculation, Dizzying Run-UPS - And Yes, A Disastrous Fall

https://archive.seattletimes.com/archive/19991226/A19991227010301/the-panic-of-99---1899-that-is-giddy-speculation-dizzying-run-ups---and-yes-a-disastrous-fall

Dec 26, 1999

NEW YORK - As the end of the century approaches, the U.S. is an economic juggernaut, the envy of the world. Investors, riding a wave of euphoria, flock to the financial markets in an unprecedented speculative flurry. A century ago it wasn't so different. The 1899 parallels with today's booming economy are remarkable. Then as now, the Dow Jones Industrial Average rallied in the final three years of the century - about 70 percent through the end of November in both cases. Commentators saw similar reasons for the gains: globalization, technological improvements, medical discoveries, the move to a market economy.

The Dow industrials shot to records as road, metal and communications companies merged and investments poured into new enterprises. Million-share days became common on the exchange, just as, 100 years later, billion-share days have become routine. Even the one or two stray clouds on the horizon seem similar. In 1899, much trepidation arose over a rise in the Bank of England's discount rate to more than 6 percent, to curb excessive strength in the economy. This year, the 30-year bond yield's move above 6 percent has caused similar distress. In 1899, the bulls were stampeded by an unfavorable Supreme Court decision on a merger involving Addison Pipe. Today, antitrust regulators are going after Microsoft, periodically scaring the daylights out of the market.

From 1899 to 1999, the Dow average rose from 66 to 11,000. Adding in dividends of about 3 percent, that works out to a compounded return of 8.25 percent. An investment of $100 in the Dow average in 1899 would be worth $280,000 today. The 19th century did end with a "buying panic" that sent the Dow up 13 percent in the last 10 trading days of 1899. One little problem: Before the buying panic, there was another kind of panic. The Wall Street Journal referred to it in December 1899 as "the most disastrous stock decline in the history of the New York Stock Exchange," and there had been some doozies. The Dow industrials dropped 23 percent from the end of November through Dec. 18, 1899. To capture the flavor of disaster that engulfed the December 1899 market, it is sobering to read the contemporaneous coverage of the leading financial publications of the time.

The Wall Street Journal, recounting the days leading up to the rout, reported the collapse of a bubble in copper stocks, bank bailouts in Boston and a disastrous British setback against the Boers in South Africa. "Complete demoralization then ensued, with money rates up to 186 percent, and with stocks being sacrificed regardless of price." In its own assessment of the carnage, the Commercial & Financial Chronicle of 1899 sounds as gloomy as Barron's does today: "It was a natural sequence of our overdone good times in marketing securities during the first months of 1899," the Chronicle's editors wrote. "As the penalty of a reckless speculation can never be escaped, it may truthfully be affirmed that we are better off today than we were 12 months ago. Then we had our troubles ahead of us. Now we have them behind us.